The Evolution of SCARA Robots in the Semiconductor Capital Equipment Industry

Back in the late 1970’s, semiconductor fabrication tool automation was in its infancy. As the industry evolved in the 1980’s, and the die count per wafer went up, SCARA robots were introduced to repeatably place the wafer in the same angular/rotational orientation at each process and inspection step. These atmospheric SCARA robots drove the single chamber process tool market up to the 6” wafer size. As the industry transitioned to 8” wafers, the desire to get more wafer throughput out of the same floor space drove the transition to cluster tools that processed several wafers at once.

This transition, from single chamber tools to cluster tools, drove the introduction of vacuum transport modules that would enable the unprocessed wafers to be safely loaded into process modules without exposing the wafers to the impurities found in the atmospheric pressure regime of the clean room. Moving the wafers from load locks, that would provide for cycling between atmospheric and vacuum pressure regimes, to the process modules all while in a vacuum environment lead to the introduction of vacuum SCARA robots.

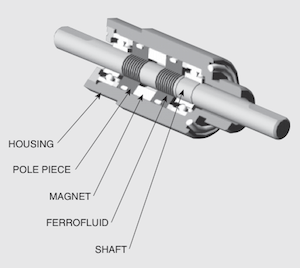

The main difference between an atmospheric SCARA and a vacuum SCARA is the seal around the z-column that enables high pressure on one side of the seal and low pressure on the other while the robot strokes up and down in the z-direction as well as rotating the arm set. Most of these seals are ferrofluidic seals, or magnetic liquid rotary seals, that utilize ferrofluids contained by permanent magnets. Crudely, one would start with an atmospheric SCARA then add a ferrofluidic seal around the z-column near the top mounting plate (the interface between atmospheric pressure and the vacuum region) and presto you have a vacuum SCARA.

As the market further evolved into the 300mm/12” wafer size, single chamber tools effectively died out sequestering atmospheric SCARA robots to the EFEM and vacuum SCARA’s in the cluster tools. This divergence impacted the value proposition of the atmospheric SCARA as it operated similarly in all EFEM’s for any give process or inspection/metrology toolset. Radically different that the origins of atmospheric SCARA’s that were tailored to a specific capex toolset and thus provided a competitive advantage for the tool OEM. This dummying down of the atmospheric SCARA effectively commoditized this robot and this lead to significant downsizing in the number of atmospheric SCARA OEM’s that supported semicapex.

In the meantime, vacuum SCARA’s evolved as the processing under vacuum complexity increased. While they had limited z-strokes (maybe up to 35mm or so) their handling requirements increased significantly. They became part of the process tool world in that they could negatively impact yields by allowing contaminates to fall onto the end effector of the robot and then instigate cross-contamination between chambers, the transport module, cooling stations and the load locks. And let’s not forget speed, since wafers per hour were the reason for cluster tools coming into being, the vacuum SCARA’s were required to move extremely quickly.

Back in the 2010 timeframe, tool OEM’s wanted the industry to transition to 450mm (18”) wafers. This was primarily because the average sales price for a new 450mm tool was significantly higher than a 300mm tool and this would help the tool OEM’s grow their business to unheard of heights. So the big American tooling OEM’s went to Washington D.C. to convince the federal government to allow for mergers previously prohibited. This would enable the tool OEM’s to achieve the critical mass necessary to launch 450mm toolsets.

But while 450mm failed, the consolidation was never undone. So while competition defined the early days of semiconductor capex, oligarchies defined the new world of capex. This brutal consolation further hammered the SCARA supply chain as with few customers, and few opportunities to define a defensible value proposition that would drive revenue and profits, the vacuum SCARA’s OEM’s started to die out just as the atmospheric SCARA’s died out 20 years previously.

The push towards 450mm was partially driven by the tooling OEM’s desire to move on from the smaller wafer sizes and only sell new equipment. And never upgrade older tools. But the risk is massive in having an entire ASIC on built on one wafer. The industry can’t accommodate reworks of work in process because so many of the process steps, once done, can’t be undone. So while the tooling OEM’s were focused on 450mm, the semiconductor fabs were focused on using their existing infrastructure of 200mm and 300mm factories.

This gave rise to “chiplets” that are basically ASIC building blocks that enable folks like Qualcomm to build their 5G Snapdragon chipsets at five different semiconductor fabs: three die’s are made at 200mm factories and two dies are made on 300mm tooling. Qualcomm has four of the chips sent to the fifth factory where all five chips are “die stacked” into a package that is then put into a leadframe that will then be encapsulated and given wires that can be then integrated into the end use device.

This radical change in the market place has extended the life of the older tooling that used single chamber tools and atmospheric SCARA’s. Unfortunately, most of the SCARA OEM’s that were used in these tools are no longer in business.

Understanding the history behind the SCARA enables our AESG techs to better understand how to repair the new models and help to develop innovative ways to continue to repair and rebuild the equipment used today in the Semiconductor industry. Let us know how we can help with your SCARAs today!